Trump’s tariff plays make for unpredictable partnerships

- 23 de set. de 2025

- 3 min de leitura

President Donald Trump’s call for G7 tariffs on China and India over cheap Russian crude during the Ukraine war offers Gulf states short-term gains but long-term questions.

US pressure on India over Russian oil

Short-term gains for Gulf suppliers

Questions about future manoeuvres

While the move may push India to buy more oil from Gulf suppliers it raises the question of how easily even the US’s closest partners, such as those in the Middle East, may be asked to support broader American goals.

“The imposition of tariffs on India and China for importing Russian oil should benefit the Gulf states, as India and China will likely turn to them for their oil needs instead of Russia,” says Steven Terner, a geopolitical analyst at Terner Consulting in New York.

The 50 percent tariff imposed by the US on India kicked in last month as trade talks stalled and Trump accused New Delhi of subsidising Russia’s offensive in Ukraine through crude purchases.

When US threats against India grew in the summer, the latter cut Russian oil buying while increasing its uptake of Middle Eastern oil. India has since placed new orders from Russia, though below levels from recent years, as it pursues the best prices, Bloomberg reported.

China, which the White House has so far spared from the additional oil-related tariffs, upped its intake of Russian crude as India receded.

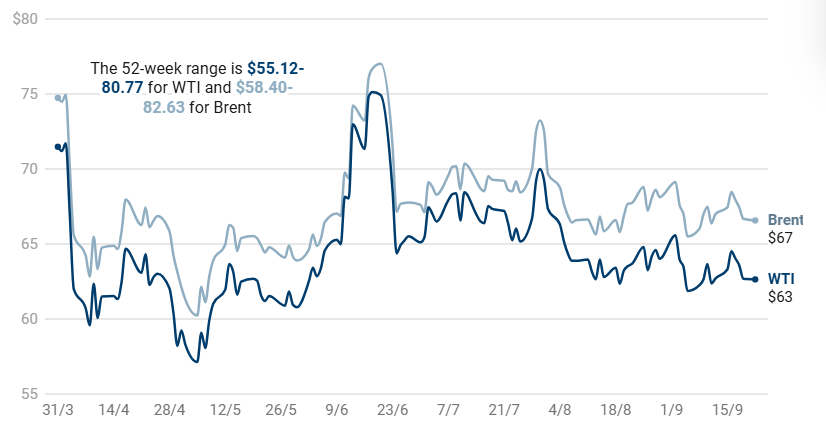

Crude oil prices

WTI and Brent prices tumbled when President Donald Trump set out his tariffs strategy in April. The Iran-Israel conflict that broke out in June also caused volatility

While the outlook remains mixed, “there is now lots of pressure on Indian refiners to stop or reduce buying Russian oil and go back to more traditional Gulf suppliers,” according to Nicolas Michelon, a managing partner at advisory firm Alagan Partners in Dubai.

“How long this will last, who knows, but we may see a short-term pivot to Middle East crude,” Michelon said.

More broadly, Trump’s request of its G7 allies triggers concerns in GCC states that they too may be “weaponised” by the US as it goes after Russia, China, India or whoever else, Michelon said.

The UAE has already experienced this. Its artificial-intelligence developer G42 was asked by Washington last year to divest holdings of Chinese tech companies to secure advanced Nvidia chips. G42 unloaded the stakes onto Lunate, an alternative investment manager backed by Abu Dhabi’s ADQ.

The move is representative of how the UAE, and Gulf states, have been able to thread the needle, for now.

“They are smart enough to understand the US priorities but also what China brings that is of absolute necessity for their diversification and development, so they are able to try to strike a very delicate balance,” Michelon said.

“But for how long can they do that? Can they strike that balance every time? There might be some cases where, no, you’re gonna have to make a choice,” he said.

The G7 nations and the European Union have thus far resisted Trump’s calls for higher tariffs on India and China over Russia’s oil.

The EU has made a “counter offer” in its 19th proposed sanctions package on Russia, which includes a ban on Russian liquified natural gas (LNG), according to Charles Lichfield, the deputy director of the Atlantic Council’s GeoEconomics Center.

“According to the new etiquette of transatlantic relations,” Lichfield writes on the think tank’s website, “the Europeans accept that they must at least engage with Trump’s demands, even when the opening bid is outlandish.”

That’s a playbook for Gulf states too, which, according to Terner, have over the years proven capable of managing to their advantage any US pressure to shift oil outputs against Russia.

Opec+ began unwinding two-year-old production cuts in April amid enforcement difficulties and Saudi Arabia’s play to increase market share. That came three months after Trump demanded that the grouping helps “bring down the cost of oil”.

Buoyed by close ties with Washington and their hefty US investments, Gulf states don’t fear being used as leverage against others, as long as it directly serves their own interests, Terner said.

By Valentina Pasquali

September 23, 2025, 4:25 PM

Comentários