Gulf states bolster military spending after strikes on Qatar

- 24 de set. de 2025

- 3 min de leitura

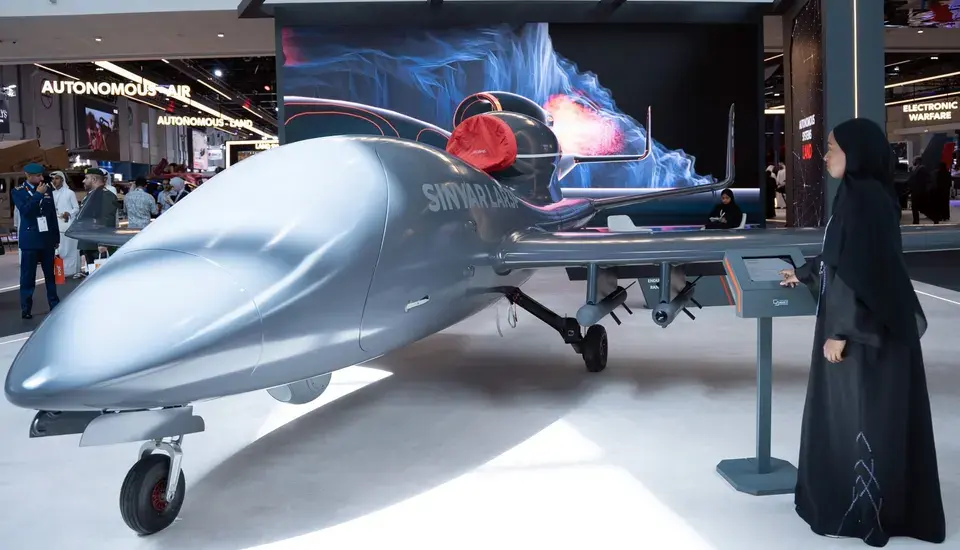

Gulf governments are stepping up their military spending to defend against missile and drone attacks and protect shipping, lifting sales for defence contractors.

GCC responds with joint defence planning

US and UK contractors expect higher demand

‘Extra protection for key sites like ports’

The six-nation GCC bloc – seen as stable despite the conflicts at its borders and the Red Sea crisis – has been jolted by two sets of strikes on Qatari soil this year.

In June Iranian missiles hit a US airbase near Doha, disrupting hundreds of flights around the Gulf. On September 9, Israeli missiles targeted Hamas leaders in the Qatari capital, heightening fears that conflict could spread across the Middle East.

Kristian Patrick Alexander, a senior fellow at Abu Dhabi-based think tank the Rabdan Security and Defense Institute, told AGBI the attacks “exposed long-range strike risks and the need to fuse a common Gulf air picture”.

Alexander added: “Governments are responding with co-ordinated early-warning and joint defence planning. This will also accelerate investment in interoperability between Gulf forces and strengthen the case for early procurement of next-generation systems – like the US-approved Patriot batteries [missile defence system] for Qatar – to close perceived capability gaps.”

The chief executive of US contractor Lockheed Martin told an investor conference this month that it had been at the centre of efforts to defend American assets and allies in the Gulf.

Jim Taiclet said the company’s missile defence systems might have helped avoid escalation after Iran’s strike on the Al Udeid airbase in June.

“All the missiles and drones that were fired … not a single life was lost. We didn’t lose a single aircraft,” he said.

“I think if those products and systems wouldn’t have been 100 percent successful, we’d be in a hot war in the Middle East right now.”

Lockheed Martin’s missiles and fire control division manufactures equipment for the US military and its allies, including the PAC-3 and THAAD systems sold to Gulf governments.

In the company’s latest results, which break down income by sector not region, it said missiles and fire control sales totalled $6.8 billion in the first half of 2025, up 12 percent on the same period in 2024. The missiles and fire control backlog stood at more than $40 billion in H1.

The company is deploying air and missile defence systems in the UAE, according to Taiclet.

Alexander said missile and drone defence would remain a top priority in Gulf procurement.

“Expect more money to go into defences that shoot down missiles and drones, tools to jam or disrupt them, stronger early-warning and command networks, and extra protection for key sites like ports, LNG terminals and airbases,” he said.

British contractor BAE Systems said Saudi Arabia, the Gulf’s largest defence market, accounted for 31 percent of its first-half sales.

“The situation in the Middle East is likely to drive higher defence spending in the region,” BAE chief executive Charles Woodburn said on its earnings call in July.

He added that Saudi Arabia’s defence budget is expected to rise by 5 percent this year, with focus areas including combat aircraft, missile systems and greater localisation of spending.

Electro Optic Systems, an Australian-listed maker of counter-drone and laser weapons, is expecting “European rearmament and a significant increase in sales into the Middle East” for the next five to 10 years.

CEO Andreas Schwer told an earnings call this month that the company was in talks over a UAE deal for its R500 remote weapon station.

Alexander said he expected “faster buying and delivery of equipment” and “weapons stockpiled closer to where they are needed,” along with more local manufacturing.

OSI Systems, a Californian company that supplied security screening equipment for the 2022 World Cup in Qatar, has also announced a $36 million contract for checkpoint and air cargo systems at an unnamed Middle East airport.

“Security isn’t just about borders,” CEO Ajay Mehra said on OSI’s earnings call last month. “It’s about protecting the nation’s biggest stages.”

He also forecast “robust” demand for cargo and aviation security from the Middle East.

By Megha Merani

September 24, 2025, 7:27 AM

Comentários